To calculate the indirect cost rate in Excel, use the formula: Indirect Costs / Direct Costs. Multiply the result by 100 for a percentage.

Understanding how to calculate the indirect cost rate is crucial for businesses. This rate helps in determining the proportion of indirect costs relative to direct costs. Indirect costs include expenses like utilities, rent, and administrative salaries that are not directly tied to a specific project.

Calculating this rate accurately ensures better budgeting and financial planning. Excel makes this calculation straightforward with simple formulas. By mastering this, businesses can allocate resources more effectively and make informed financial decisions. This ultimately leads to more efficient operations and improved profitability.

Introduction To Indirect Costs

Understanding indirect costs is vital for any business. These costs help determine the true expense of running a business. Calculating the indirect cost rate using Excel formulas can save time and increase accuracy.

Definition

Indirect costs are expenses not directly tied to a specific product or service. These costs include utilities, rent, and administrative salaries. Indirect costs support the overall operation of the business.

They differ from direct costs, which are directly linked to production. While direct costs are easy to assign, indirect costs require a different approach. This is where calculating the indirect cost rate becomes crucial.

Importance

Knowing your indirect cost rate is essential for budgeting and financial planning. It helps businesses allocate resources more effectively. An accurate indirect cost rate ensures fair pricing of products and services.

Here are some key reasons why understanding indirect costs is important:

- Helps in setting competitive prices

- Aids in identifying cost-saving opportunities

- Improves financial transparency

Using Excel formulas simplifies this process. Excel helps in automating the calculation, making it less error-prone. Below is a simple table that shows common indirect costs:

| Type of Indirect Cost | Example |

|---|---|

| Utilities | Electricity, Water |

| Rent | Office Space |

| Administrative Salaries | HR, Accounting |

Calculating your indirect cost rate in Excel involves these steps:

- Identify total indirect costs.

- Determine the direct costs.

- Divide total indirect costs by direct costs.

Following these steps helps in accurate cost allocation. This also assists in better financial decision-making.

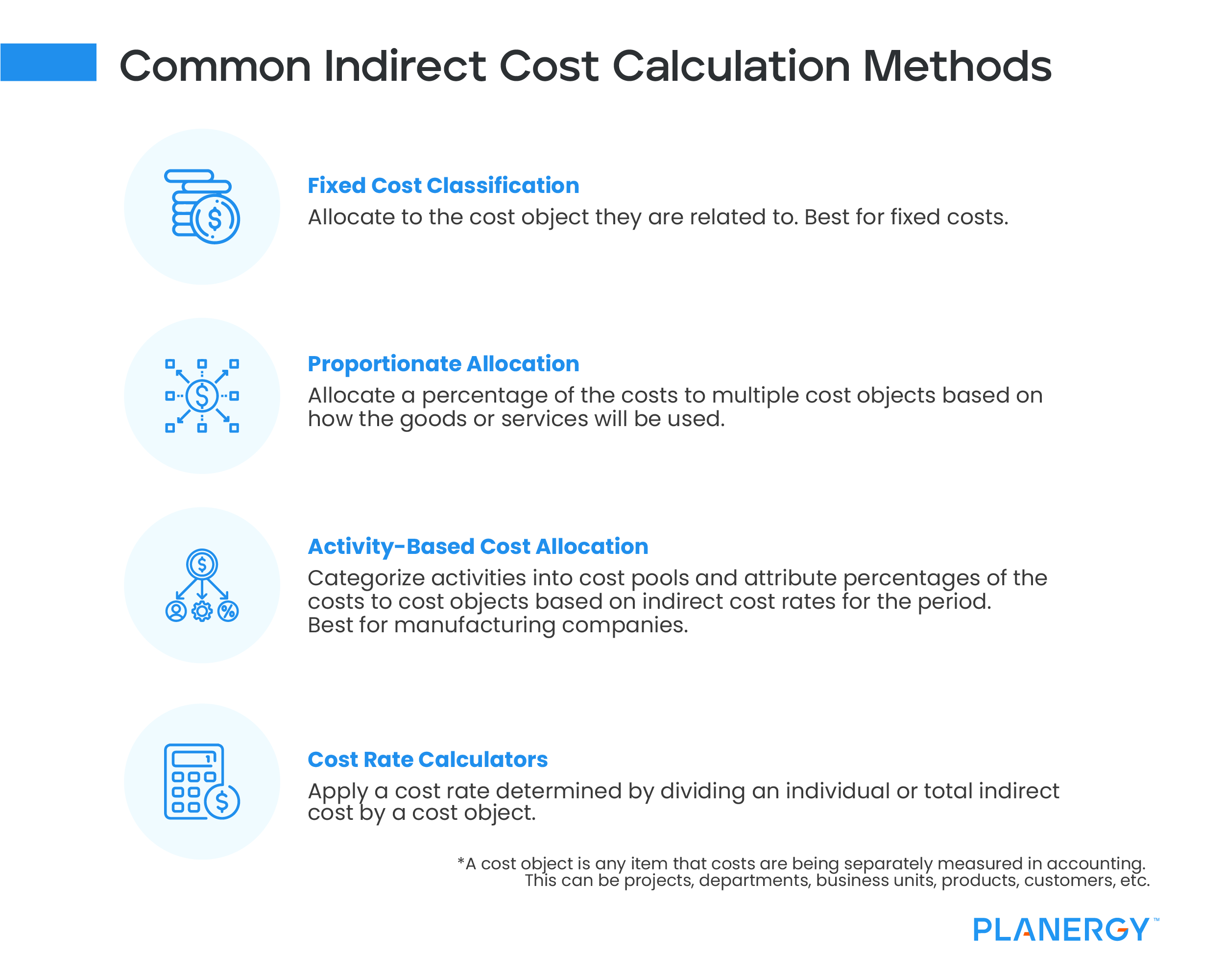

Credit: planergy.com

Components Of Indirect Costs

Understanding the components of indirect costs is crucial for accurate financial management. These costs are not directly tied to a specific project or product. Instead, they support various functions within an organization. Let’s explore two primary components: Administrative Expenses and Facility Costs.

Administrative Expenses

Administrative expenses include costs related to managing the organization. These expenses are essential for daily operations but do not directly contribute to product creation.

- Salaries of administrative staff

- Office Supplies such as paper, pens, and computers

- Professional Services like legal and accounting fees

- Software Subscriptions for administrative tools

These expenses are shared across multiple projects. Tracking them helps in calculating the overall indirect cost rate accurately.

Facility Costs

Facility costs cover expenses related to maintaining the physical space of the organization. These costs are necessary for providing a productive work environment.

- Rent or lease payments for office space

- Utilities like electricity, water, and internet

- Maintenance and repairs of the building

- Insurance for property and liability

Facility costs are indirect but critical for the overall function of the organization. Properly allocating these costs ensures fair distribution across all projects.

To manage these costs efficiently, use an Excel formula to calculate the indirect cost rate. This helps in budgeting and financial planning.

Calculating Indirect Cost Rate

Calculating the indirect cost rate is essential for businesses. It helps in understanding the overhead costs. Using an Excel formula simplifies this process. This section will guide you through the process.

Basic Formula

The indirect cost rate formula is straightforward. You need two key figures:

- Total Indirect Costs

- Total Direct Costs

The basic formula is:

Indirect Cost Rate = (Total Indirect Costs / Total Direct Costs) 100

This will give you a percentage. It represents your indirect cost rate.

Example Calculation

Let’s look at an example. Assume your business has the following costs:

| Cost Type | Amount |

|---|---|

| Total Indirect Costs | $50,000 |

| Total Direct Costs | $200,000 |

Using the formula:

Indirect Cost Rate = ($50,000 / $200,000) 100

This calculation gives:

Indirect Cost Rate = 25%

So, the indirect cost rate is 25%.

Calculating this in Excel is simple. Use a formula like:

= (B2 / B3) 100

Where B2 is the cell for Total Indirect Costs, and B3 is for Total Direct Costs.

Setting Up Excel For Calculation

Setting up Excel for calculating the indirect cost rate is simple. Excel’s powerful tools make the process easy and efficient. Follow these steps to get started.

Creating The Spreadsheet

First, open Excel and create a new spreadsheet. Name the spreadsheet something clear, like “Indirect Cost Rate Calculation.”

Next, set up your columns. You will need columns for:

- Category

- Direct Costs

- Indirect Costs

- Total Costs

Arrange these columns in the first row. This setup helps you keep data organized.

Inputting Data

In the “Category” column, list your cost categories. These might include:

- Salaries

- Rent

- Utilities

- Office Supplies

Enter the amounts for each category in the “Direct Costs” and “Indirect Costs” columns. Fill in data for all your cost items.

To calculate the total costs, use this formula in the “Total Costs” column:

=B2+C2

This formula adds the direct and indirect costs together. Drag the formula down to apply it to all rows.

Now, your data is ready for further calculations. This setup ensures you have a clear overview of all costs.

Using Excel Formulas

Using Excel formulas makes calculating the indirect cost rate easy. This guide shows how to use two key Excel functions: the SUM Function and the Division Formula. These functions help in calculating indirect costs quickly.

Sum Function

The SUM Function adds up multiple numbers. It is useful for summing different costs. Here’s how to use it:

- Click on an empty cell.

- Type

=SUM(. - Select the cells with the costs.

- Close the bracket with

). - Press Enter.

For example, to add costs in cells A1 to A5, type =SUM(A1:A5) and press Enter. This gives the total indirect costs.

Division Formula

The Division Formula divides one number by another. It calculates the indirect cost rate. Here’s how to use it:

- Click on an empty cell.

- Type

=. - Select the cell with total indirect costs.

- Type

/. - Select the cell with total direct costs.

- Press Enter.

For instance, to divide cell B1 (total indirect costs) by cell B2 (total direct costs), type =B1/B2 and press Enter. This gives the indirect cost rate.

Here’s a simple table for clarity:

| Step | Action | Example |

|---|---|---|

| 1 | Sum Indirect Costs | =SUM(A1:A5) |

| 2 | Calculate Cost Rate | =B1/B2 |

Using these Excel formulas simplifies cost calculations. They save time and reduce errors.

Automating The Calculation

Automating the calculation of the indirect cost rate in Excel saves time. It reduces the chance of errors. Use Excel’s powerful features to streamline this process. Below are detailed steps to achieve this. Learn how to use macros and create templates to automate your calculations.

Using Macros

Macros help automate repetitive tasks. They are especially useful in Excel. Follow these steps to create a macro for calculating the indirect cost rate:

- Open Excel and go to the Developer tab.

- Click on Record Macro.

- Name your macro and assign a shortcut key.

- Perform the calculation steps manually. Excel records each step.

- Click on Stop Recording.

To run your macro, press the shortcut key. Excel performs the calculation automatically.

Creating Templates

Templates save time by providing a ready-to-use format. Create a template for calculating indirect cost rates:

- Open Excel and create a new workbook.

- Enter the necessary headings and formulas.

- Format the cells as required.

- Save the workbook as a template. Click File > Save As > Excel Template.

Use this template for future calculations. It ensures consistency and accuracy.

| Step | Description |

|---|---|

| 1 | Open Excel and create a new workbook |

| 2 | Enter headings and formulas |

| 3 | Format cells as needed |

| 4 | Save as an Excel Template |

Templates and macros make calculating indirect cost rates easy. They ensure the process is efficient and error-free.

Common Mistakes To Avoid

Calculating the indirect cost rate in Excel can be tricky. Many make mistakes that can lead to wrong results. Avoiding these mistakes is essential for accurate calculations. Here are some common mistakes to look out for.

Data Entry Errors

Data entry errors are common in Excel. Entering wrong numbers can lead to wrong results. Always double-check your data. Use the Excel data validation feature. This helps in reducing errors. You can set rules for what data is allowed. This ensures only correct data is entered.

Another tip is to use drop-down lists. They limit the choices users can enter. This reduces the chances of errors. Always format your cells properly. For example, use the currency format for cost data.

Formula Errors

Formula errors can be tricky to spot. They can throw off your calculations. Always use the correct formula for indirect cost rate. A common formula is:

=SUM(Indirect Costs) / SUM(Direct Costs)Make sure you reference the right cells. Wrong cell references can lead to wrong results. Use the Excel audit tool to check your formulas. It helps in identifying errors and correcting them.

Another tip is to use named ranges. They make your formulas easier to read. They also reduce the chances of errors. Always test your formulas with sample data. This helps in ensuring they work correctly.

Credit: www.wallstreetprep.com

Practical Applications

Understanding how to calculate the Indirect Cost Rate using Excel can transform your business. This skill is valuable for various practical applications. Let’s explore how it can benefit Business Budgeting and Project Management.

Business Budgeting

Businesses need accurate budgeting to thrive. Calculating the Indirect Cost Rate in Excel helps in this task.

Here’s a simple formula to use in Excel:

= (Total Indirect Costs / Total Direct Costs) 100

This formula calculates the percentage of indirect costs. It helps you understand the actual cost structure.

Benefits of using this formula in budgeting include:

- Improved Cost Allocation: Accurate tracking of indirect costs.

- Better Financial Planning: More reliable budget forecasts.

- Resource Optimization: Efficient resource allocation.

Project Management

Project managers need to control costs. Calculating the Indirect Cost Rate in Excel is crucial.

Use the same formula to find indirect costs:

= (Total Indirect Costs / Total Direct Costs) 100

This helps in understanding project expenses better.

Key advantages include:

- Accurate Project Costing: Identifies true project expenses.

- Enhanced Budget Tracking: Keeps project costs under control.

- Informed Decision Making: Provides data for better project decisions.

Using Excel for this calculation ensures transparency in project finances.

It also aids in maintaining project budgets.

Credit: www.ala.org

Frequently Asked Questions

What Is An Indirect Cost Rate?

An indirect cost rate is the ratio of indirect costs to direct costs.

How To Calculate Indirect Cost Rate In Excel?

Divide total indirect costs by total direct costs. Multiply by 100 for a percentage.

What Are Examples Of Indirect Costs?

Examples include administrative expenses, utilities, and rent.

Why Is Indirect Cost Rate Important?

It helps allocate overhead expenses fairly across projects.

Can Excel Automate Indirect Cost Calculations?

Yes, Excel formulas can automate and simplify indirect cost calculations.

How Do You Enter Costs In Excel?

List direct and indirect costs in separate columns for clarity.

Conclusion

Mastering the indirect cost rate formula in Excel simplifies budgeting. It ensures accurate financial planning and efficiency. By following the steps outlined, you can optimize resource allocation. Make sure to regularly update your data for precision. This approach enhances your financial management and supports informed decision-making.